the Mathematics of Investment and Credit

Understanding the Mathematics of Investment and Credit: A Modern Guide

What Is the Mathematics of Investment and Credit?

The two main components of financial growth are borrowing and investing. The instruments for analyzing these financial operations are provided by the mathematics of credit and investment. Formulas, methods, and models for figuring out interest, annuities, loan payments, yield rates, and bond prices are all included in this topic. These mathematical tools are used by investors, actuaries, and financial experts to make well-informed decisions.

Time Value of Money in the Mathematics of Investment and Credit

The time value of money is one of the fundamental ideas in this area. It claims that because of its earning potential, money that is available today is worth more than the same amount in the future. Comparing various investment possibilities is made easier by calculating present and future values. These formulae are used by investors to assess everything from real estate prospects to retirement funds.

Interest Rates and Their Role in Investment Mathematics

Interest rates have an impact on all financial choices. It’s crucial to comprehend how simple and compound interest operate. In long-term investments, compound interest in particular is important. When used over time, wealth increases tremendously. The impact of fluctuating rates and compounding periods on the results of investing strategies is discussed in this section

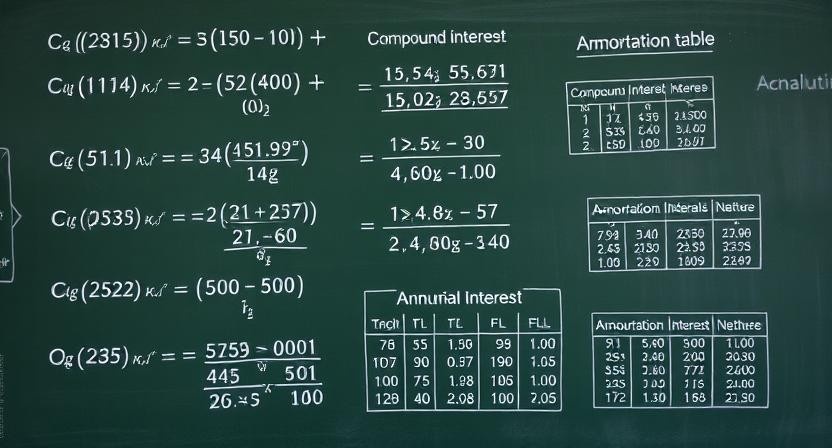

Calculating Compound Interest Accurately

The compound interest formula is essential for accurately calculating returns:

P(1 + r/n)^(nt) = A

Where:

A is the total sum.

The principal is P.

The yearly interest rate is denoted by r.

The number of compounding periods is denoted by n.

The time is in years.

This formula is fundamental to the mathematics of credit and investments, particularly when it comes to retirement and savings planning.

Loans, Amortization, and Credit Applications

When you borrow money, you have to pay it back over time. For both individuals and corporations, it is essential to comprehend loan amortization. Amortization schedules break down loan payments into principle and interest over time. Borrowers can see the effects of additional payments on loan terms, including monthly payments and the total cost of credit.

Amortization Example: Fixed-Rate Mortgage

Take a look at a $200,000 loan with a 30-year term and 5% APR. Principal and interest will be paid each month in a combination determined by the amortization method. Interest makes up the majority of early payments, while principal grows over time. Borrowers can make better plans and cut debt more effectively if they are aware of this.

Annuities in Investment Planning

Annuities are frequently used when preparing for retirement. Over time, they entail consistent payments given or received. Future value and present value formulas are part of the mathematics underlying annuities. These are employed in long-term saving plans, structured settlements, and pension planning.

Ordinary Annuities vs Annuities Due

Regular Annuity: At the conclusion of each period, payments are made.

Annuity Due: At the start of every period, payments are made.

Everybody has a different formula. Over time, selecting the appropriate annuity type affects the overall return or cost.

Real-Life Application of Mathematics of Investment and Credit

Credit and investment mathematics are not merely theoretical; they have an impact on day-to-day financial choices. These ideas guarantee superior results whether you’re investing in a business, saving for a car, or purchasing a home. These computations are used by financial advisors to suggest tactics according to a client’s objectives and risk tolerance.

Broverman SA Mathematics of Investment and Credit Eighth Edition 2024

One of the most well-known books on financial mathematics is The Broverman SA Mathematics of Investment and Credit, Eighth Edition 2024. For subjects like interest theory, annuities, loans, bonds, and yield rates, it provides comprehensive explanations and problem sets. Updates pertinent to the current financial environment and actuarial tests are included in the most recent edition. Both professionals pursuing actuarial certifications and academic institutions use it.

Why This Edition Matters

- reflects the rules governing finance today.

- Examples that have been updated to use contemporary financial instruments

- designed to conform to the existing curricula for actuarial exams

- Because of this, it is a useful tool for both financial professionals and students.

Bonds and Yield Rates

One important use of investing mathematics is bond pricing. Bonds refund the principal at maturity and offer periodic interest in the form of coupons. By figuring out a bond’s present value, investors can determine if the price is reasonable. Another important metric is yield to maturity (YTM), which calculates the projected return if the bond is held to maturity.

Bond Pricing Formula

The present value of a bond’s final principle repayment and future coupon payments, discounted at the market rate, is its price. This is where understanding credit and investing mathematics becomes crucial. It guarantees that investors may evaluate bonds with varying terms, rates, and maturities.

Deferred Annuities and Advanced Topics

- After a waiting period, deferred annuities start paying out. They are helpful in preparing for future income requirements, like those that would arise after retirement. Other advanced investment subjects include:

- Bond duration and convexity

- Methods of immunization

- Analysis of interest rate risk

- These need for a more thorough comprehension of mathematical ideas used in real-world financial situations.

Practical Skills You Gain from Learning Investment Mathematics

Learning investment math develops practical abilities. It improves decision-making and financial literacy. The following are some developed core capabilities:

evaluating various investment choices according to return on investment

Creating arrangements for loan payback

Finding the amount of money needed for retirement

Recognizing trade-offs between risk and return

These abilities enable people to take charge of their financial destiny.

How Technology Supports Financial Math

Contemporary computing tools can help apply these ideas more rapidly. Excel functions like FV, PV, RATE, and PMT automate calculations.Additionally, financial apps and calculators have built-in features that use formulas related to credit and investment mathematics. Users can validate outcomes more effectively if they understand the arithmetic underlying the technologies.

Career Opportunities with Knowledge in Investment Mathematics

- Gaining knowledge in this area can lead to opportunities in banking, investment management, actuarial science, and finance. Experts in financial modeling are in high demand. A solid mathematical foundation is necessary to comprehend how to price insurance contracts or assess investment items.

- Typical roles consist of:

- An actuarial analyst

- Advisor for investments

- Analyst of credit risk

- Expert in corporate finance

Conclusion: Why Everyone Should Learn the Mathematics of Investment and Credit

Knowing the basics of credit and investing allows one to confidently negotiate intricate financial systems. This information helps make informed decisions about everything from retirement savings to bond return analysis. This topic provides a strong basis regardless of your background—student, professional, or just interested in accumulating wealth. Gaining proficiency in these areas becomes progressively more important as financial markets change.